BY BADER ARSLAN

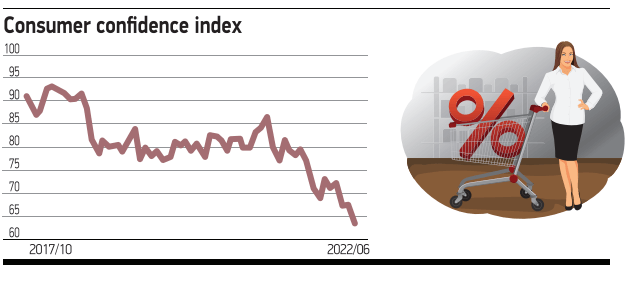

The consumer confidence index decreased to 63.4 in June, indicating that consumers’ trust in the economy in Turkey has never been this low.

The consumer confidence index has experienced two major breakdowns in recent years: the first in the fall of 2018 and the second in the fall of 2021. The index, which hovered around 90 for years, started to see values around 80 after fall 2018. The bottom has not been seen reached in the breakdown that began in fall 2021. (See graph: Consumer confidence index)

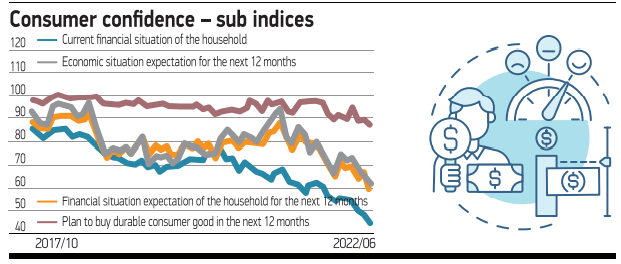

Four sub-indices determine consumer confidence: The current economic situation of the household, the economic situation expectation of the household for the next 12 months, the general economic situation expectation for the next 12 months, and the perspective on purchasing durable consumption goods for the next 12 months. There was a decline in all of these sub-indices in June and they all fell to historic lows. (See graph: Consumer confidence – sub-indices)

Another interesting point regarding the course of the sub-indices is this: all four have regressed collectively in six of the last nine months. In the normal conjuncture, some of the sub-indices would rise while others would fall. For example, while the current financial situation of households deteriorates, the general economic situation may improve. However, we have seen that all sub-indices are steadily declining as of late.

MAIN CAUSE OF FOOD INFLATION? AN INCREASE IN INPUT COSTS

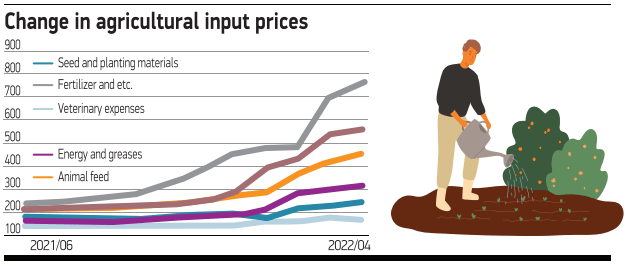

One of the most important pieces of data released last week was the agricultural input price index. Agricultural input prices increased by 7.5% in April compared to the previous month and increased by 117.3% compared to last year.

The input item with the fastest increase in agricultural inputs prices is fertilizer. Fertilizer prices have nearly tripled in the last year. One reason for this is that fertilizer prices have increased in dollar terms around the world. Another reason is the increase in the domestic exchange rate.

Energy is the most expensive input after fertilizer. In the last 12 months (from April to April), there has been a 229% increase in diesel prices, 108% in electricity prices, and 242% in coal prices. (See graph: Change in agricultural input prices)

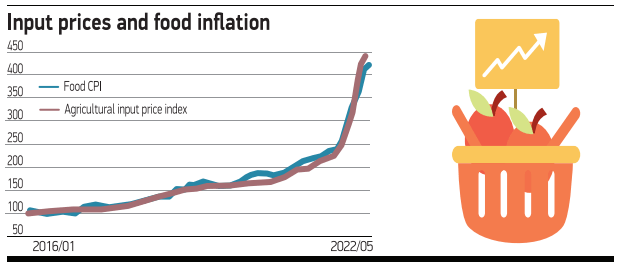

Most of the examples mentioned in the inflation debates in Turkey belong to food products. There is a very close relationship between food inflation and agricultural input prices in the long run. In other words, food inflation is largely due to the expense of production. The graph that brings together the CPI food and non-alcoholic beverage index and the agricultural input price index (assuming the 2015 values as 100) reflects this relationship well. (See graph: Input prices and food inflation)

Of course, logistics, warehousing, wholesale market halls, and supermarkets also have an impact on prices. But they don’t seem to have as big of an impact as core input costs.

MPC DECISION AS EXPECTED

There was no change in the interest rate following the Monetary Policy Committee (MPC) meeting on Thursday, as expected. Since the policy rate is far below the inflation rate and is not used for a purpose, such as fighting against inflation, MPC meetings are no longer being watched closely. For this reason, the MPC statement and its content, announced every month, are not examined closely.

Fighting inflation is the reason for the existence of the Central Bank and this is written in its charter. However, the Bank is not fighting inflation and leaves this mission to macroprudential policies partly implemented by itself and partly by the Banking Regulation and Supervision Agency.

TURKEY’S R&D LEADERS ANNOUNCED

Monthly economy journal Turkishtime announced the results of the R&D 250, the Companies Making the Most R&D Expenditures in Turkey, for the ninth time this year. The study fills an important gap in Turkey; it is the only report of its kind.

While the total R&D expenditure of the companies participating in the research was TRY 25.5bn, Aselsan ranked first with an R&D expenditure of TRY 5.6bn. Five of the top 10 companies on the list are companies from the defense industry. Although it may not seem like a big deal, since we see a similar picture every year; it is of great importance that two-thirds of the total R&D expenditures in 2021 were made by defense companies.

ALL EYES ON PMI DATA

This week, all eyes will be on the PMI indices that will be announced on Friday morning. The indices that will be announced both in Turkey and in other leading countries will be watched closely this time. Institutions such as the IMF, OECD, World Bank, and national authorities are revising their 2022 growth forecasts downwards, and there are signs of a slowdown in PMI data in the coming months.