BY ALAATTIN AKTAS

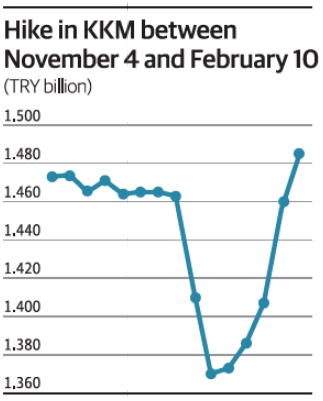

Savers started to rapidly close their FXprotected TRY deposit accounts (KKM) after FX rates hadn’t increased for months and the interest rate cap had fallen to 12% following the policy rate cut to 9%. The total amount in KKM dropped by TRY 48bn in the last week of December and TRY 45bn in the first week of January. The decline paved the way for the management of the economy to take an action. The Central Bank removed the interest rate cap for KKM transactions for those, who would return from the FX deposit accounts with an official letter on January 25. On one hand, banks have started to offer more attractive interest rates for savers, on the other hand, they have started to announce new instruments after the upper limit for interest rates was lifted. The total amount in the KKM has been rising since January 6, following a total decline of TRY 93bn in the last week of December and the first week of January. The hike has totaled TRY 114bn over the past five weeks. The total amount in KKM reached TRY 1.48tr on February 10, hitting an all-time high. Account owners, who want to protect their savings, have rushed into KKM to be protected from the FX rate hike and get a relatively higher interest rate as long as FX rates don’t rise. Apparently, the rally will continue in the upcoming period.